Hastings County Council has approved their 2024 budget.

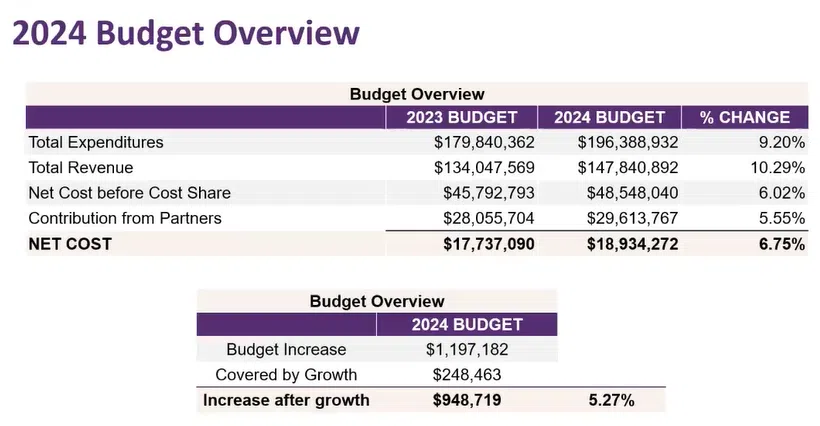

Year over year, the budget increased by 6.75 per cent, however, after growth is factored in it comes in at 5.27 per cent.

Expenditures increase by $16.6 million or 9.2 per cent, however, revenue also jumped 10.3 per cent or $13.8 million.

MORE BELOW

There are many shared services Hastings County has with the City of Quinte West and the City of Belleville. Of those services, 29 per cent of the cost is undertaken by Hastings County, 30 per cent Quinte West, and 41 per cent Belleville.

One per cent of the levy, or around $177,000, is going to be set aside for a Roads Capital Reserve.

Emergency Services will see an eight per cent increase, however, much of that jump is due to the Stirling-Rawdon paramedic base, along with a partnership with the Mohawks of the Bay of Quinte, providing paramedic services in Tyendinaga.

The capital projects portion of the budget is $33.5 million. The largest project is the 32-unit building to be constructed on South Street in Trenton.

MORE BELOW

Other committee increases show Planning/911/ Economic Development increase 13.5 per cent, while Community and Human Services jump 7.36 per cent.

One of the highlights is the revenue increase anticipated for Highway Traffic Act offenses. Belleville is installing Automated Speed Enforcement starting this summer.

There is a decrease coming for the administration of the Ontario Works Funding program.

Council approved an increase to the long-term care budget of 4.15 per cent to help meet the costs and obligations to provide four hours of care to residents of Hastings Manor in Belleville and Centennial Manor in Bancroft.

An additional $100,000 is being placed in the Community Grants Fund to help meet the massive increase in requests.

Tweed Mayor Don DeGenova says supporting these grants can be a slippery slope.

“All of a sudden, we’re going to be inundated with the requests and it’s going to be very, very, difficult because we’re going to have to likely pit against one another to find where that money is going to come from. I recognize the need, the contributions, that all of those organizations play in our communities, but we have to have to be mindful of the impact that it is going to have.”

Taxpayers will see about an annual increase of $35 on every $200,000 of housing value.